The Shadow Games Series

Shadow Games Series: Episode 1 | The Fine Line: Lobbying vs. Bribery

Shadow Games Series: Episode 2 | The Shell Game: How Money Hides

Shadow Games Series: Episode 3 | The Oligarch’s Playbook: Consolidating Power

Shadow Games Series: Episode 4 | The Cost of Corruption: The Human Toll

Shadow Games Series: Episode 5 | Cleaning House: Can It Be Fixed?

Shadow Games Series: Episode 3 | The Oligarch’s Playbook: Consolidating Power

The Architecture of Permanence

There is a fundamental misunderstanding about how the game of power is played. Most people assume the goal is simply to win—to make the most money, to get the most votes, to secure the most fame. But winning is a temporary state. A champion can be defeated; a fortune can be squandered; a president can be impeached. The true masters of the game, the modern oligarchs, do not care about winning a single round. Their objective is far more ambitious: they want to buy the casino.

In our previous discussions, we explored how influence is rented through lobbying (Episode 1) and how wealth is hidden through shell companies (Episode 2). Now, we arrive at the final boss level: Consolidation. This is the art of turning temporary advantage into permanent dominance. It is the process by which the “ultra-wealthy” transform themselves into the “untouchable.”

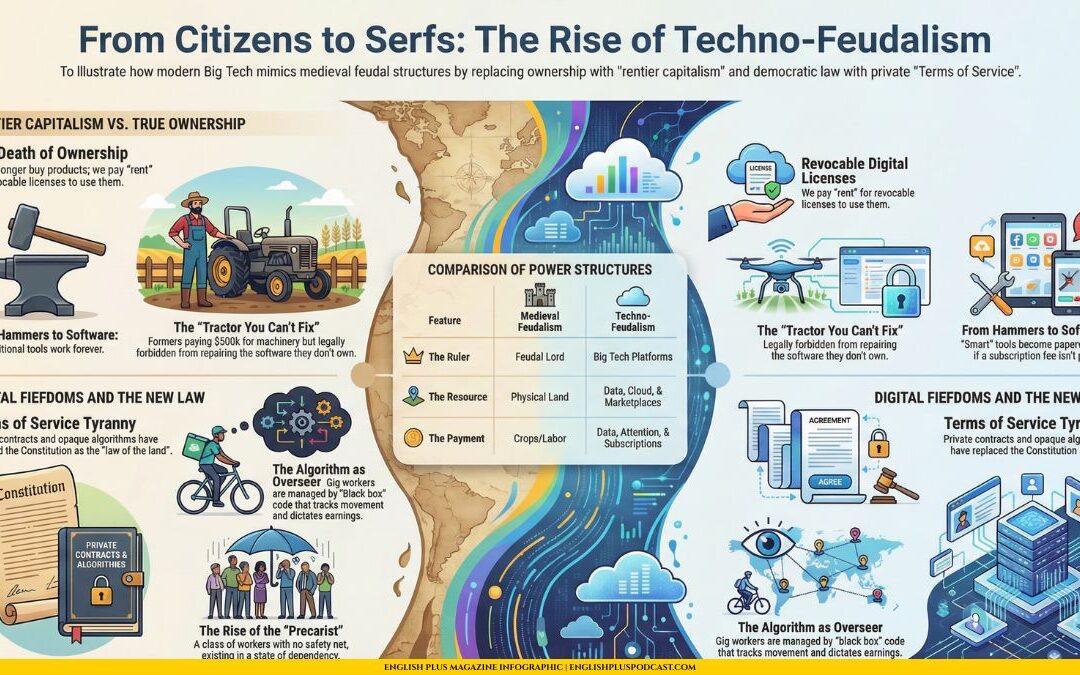

When we hear the word “oligarch,” our minds often drift to caricature—stern men in fur coats on superyachts in the Mediterranean. However, oligarchy is not a nationality; it is a structural reality. It is a system where power effectively rests with a small number of people. Whether they are tech tycoons in Silicon Valley, energy barons in Texas, or media moguls in London, the playbook remains strikingly consistent. To secure their reign, they must control three critical pillars: the narrative, the rules, and the risk.

Pillar One: The Media Monopoly

Napoleon Bonaparte once remarked that he feared three newspapers more than a hundred thousand bayonets. He understood that while an army can conquer territory, only a story can conquer the mind. In the Information Age, this maxim has evolved from a philosophical observation into a business strategy.

If you control the flow of information, you do not need to silence your critics; you simply drown them out. This is the essence of the Media Monopoly.

In the mid-20th century, the media landscape was relatively fragmented. A city might have three or four independent newspapers, local radio stations, and regional broadcasters. Today, through a relentless process of mergers and acquisitions, the vast majority of what we read, watch, and listen to is controlled by a handful of colossal conglomerates.

This consolidation is not merely about efficiency; it is about “agenda setting.” The power of the media is not necessarily in telling you what to think, but in telling you what to think about.

Imagine a factory owned by a media conglomerate is polluting a local river. If that conglomerate also owns the local news station, the story of the pollution might simply never air. Or, perhaps more subtly, it will air, but it will be framed as a “job-killing regulation issue” rather than an “environmental health crisis.”

This control extends beyond suppression. It allows for the manufacturing of consent. When a billionaire buys a newspaper—often at a financial loss—they are not buying a business; they are buying a megaphone. They are purchasing the ability to elevate fringe ideas into mainstream discourse or to cast reasonable policies as radical dangers. By owning the platforms where public debate occurs, the oligarch ensures that the debate never strays into territory that might threaten their bottom line.

Pillar Two: Regulatory Capture

If controlling the media is about winning the hearts and minds, controlling the regulators is about securing the wallet. This brings us to “Regulatory Capture,” a phenomenon that turns the concept of government oversight on its head.

In a healthy democracy, government agencies act as referees. The Environmental Protection Agency (EPA) watches the polluters; the Securities and Exchange Commission (SEC) watches the bankers; the Food and Drug Administration (FDA) watches the pharmaceutical giants. The referee’s job is to ensure the game is fair and the players are safe.

Regulatory Capture occurs when the teams start hiring the referees.

The mechanism is often subtle. It rarely involves a briefcase of cash. Instead, it relies on the complexity of modern industry. Who understands the intricate chemistry of a new pesticide better than the scientists who developed it? Who understands the labyrinthine derivatives market better than the bankers who invented it?

When the government needs to staff these regulatory agencies, they inevitably look to the private sector for expertise. Consequently, the head of the agency regulating the banks is often a former bank CEO. The person in charge of aviation safety is a former airline executive.

On the surface, this makes sense; you want experts. But in practice, it creates a symbiotic relationship where the regulator identifies more with the industry than with the public. They hesitate to crack down on their former colleagues (and future employers).

Furthermore, these captured agencies often use regulation as a weapon against competition. A massive corporation can easily afford an army of lawyers to navigate complex new compliance rules. A small startup cannot. Therefore, the oligarchs often welcome heavy regulation, provided they get to write the fine print. The regulations become a moat, a barrier to entry that protects the incumbent giants from eager young challengers. The “watchdog” has been fed a steak and is now guarding the burglar.

Pillar Three: Too Big to Fail

The final pillar of the playbook is the most audacious: the construction of institutions so massive, so interconnected, and so vital to the economy that their collapse would cause catastrophic damage to the entire system. This is the doctrine of “Too Big to Fail.”

In a true free market, risk is the price of reward. If you make a bad bet, you lose your money. If your company is inefficient, it goes bankrupt. This is the Darwinian engine of capitalism; it clears out the dead wood to make room for new growth.

The oligarch’s goal is to short-circuit this engine. By merging and acquiring until they reach a gargantuan scale, they effectively take the economy hostage.

Consider the financial crisis of 2008. The major banks had become so entangled with the global economy that letting them fail—which, by free-market rules, they should have—would have allegedly resulted in a new Great Depression. The government was forced to step in with taxpayer money to bail them out.

This creates a perverse incentive structure known as “moral hazard.” If I know that I keep the profits when I win, but the taxpayer covers the losses when I lose, I will bet with reckless abandon. I will take existential risks because I have an existential safety net.

This logic extends beyond banking. We see it in tech platforms that have become the de facto public square, in defense contractors that are the sole suppliers of military hardware, and in utility companies that power the grid. These entities have ceased to be mere companies; they have become infrastructure. They have privatized the gains of success while socializing the risks of failure.

The Moat and the Castle

When you combine these three pillars, you see the full architecture of the fortress.

The Media Monopoly ensures that the public remains distracted or divided, focusing on culture wars rather than economic structuralism. Regulatory Capture ensures that the government, which is supposed to wield the hammer of the law, is instead wielding a rubber stamp. And the “Too Big to Fail” status ensures that even if the oligarchs make a catastrophic mistake, the public will be forced to pay the bill to save them.

This is not a conspiracy in the theatrical sense; there are no shadowy figures meeting in a volcano lair. It is simply the logical endpoint of unchecked accumulation. It is the result of a system where money reproduces itself faster than labor can earn it, and where that money is intelligently deployed to dismantle the very checks and balances designed to contain it.

The oligarch’s playbook is not about breaking the law. It is about realizing that if you have enough chips, you no longer have to play by the rules—you can buy the rulebook.

Critical Analysis: The Devil’s Advocate

The Complexity of Competence

We have sketched a portrait of a rigged system, a closed loop where the wealthy use their resources to pull up the ladder behind them. It is a compelling narrative of disenfranchisement. But is it the whole truth? Is consolidation purely a mechanism of greed, or does it serve a necessary function in a chaotic world?

Let us adopt the role of the skeptic. Let us challenge the assumption that “big” is inherently “bad” and that “influence” is synonymous with “corruption.”

The Double-Edged Sword of Media Fragmentation

We decried the “Media Monopoly” as a tool for manufacturing consent. But consider the alternative. In the age of the internet, the monopoly of the old broadcast giants has arguably shattered. Today, anyone with a smartphone is a broadcaster. We have achieved the democratization of information.

And what is the result? Is it a utopia of truth? One could argue we are now suffering from the opposite problem: a “cacophony of confirmation bias.”

When media was consolidated, there was at least a shared baseline of reality—a “watercooler” consensus. Now, the audience is fragmented into thousands of micro-realities. Algorithms feed us exactly what we want to hear, radicalizing us and eroding social cohesion.

A critical thinker might ask: Was the “gatekeeper” model of the old media oligarchs actually a stabilizing force? Did the editors of the major papers act as a filter for conspiracy theories and nonsense? Perhaps the danger isn’t just the concentration of media power, but the total disintegration of a shared narrative, leaving us vulnerable to populism and misinformation that spreads faster than any oligarch could control.

The Necessity of the Revolving Door

Let us re-examine “Regulatory Capture.” We painted the “Revolving Door” as a corrupt exchange of favors. But let’s look at the practicalities of governing a technological society.

If you need to regulate Artificial Intelligence, you cannot hire a generalist bureaucrat. You need someone who understands neural networks, large language models, and algorithmic bias. Where do these people exist? They are currently working for Google, OpenAI, and Microsoft.

If the government bans anyone with industry ties from working in regulation, they are effectively banning expertise. You would end up with a regulator who is well-meaning but incompetent—someone who bans the wrong things because they don’t understand the technology.

Is it possible that what looks like “capture” is actually “competence”? The challenge isn’t to stop the revolving door, but to slow it down—to ensure that the expert is serving the public interest while they are in office. But to assume that all industry experience creates corruption is to assume that no professional can separate their past job from their current duty. That is a cynical view of human nature that ignores the many public servants who genuinely try to use their insider knowledge to fix the system.

The Stability of Giants

Finally, let’s look at “Too Big to Fail.” We framed this as a moral hazard. But there is an economic argument for scale.

Huge institutions provide stability and efficiency that small players cannot. A massive bank can fund a multi-billion dollar infrastructure project—a dam, a railway, a green energy grid—that a local credit union could never touch. A massive tech company like Amazon can build a logistics network that delivers goods to rural areas cheaply and efficiently, raising the standard of living for millions.

We, the consumers, vote for these oligarchies with our wallets every day. We prefer the convenience of the giant over the charm of the small. We like that our phone works globally; we like that our package arrives tomorrow.

If we were to smash these companies into a thousand pieces, we might regain a sense of “fairness,” but we would likely lose significant economic efficiency. Prices might rise; innovation might slow down because the massive R&D budgets of the giants would evaporate.

The Invisibility of the “Benign Oligarch”

Furthermore, we tend to notice the oligarchs only when they behave badly. We rarely discuss the “benign oligarch”—the billionaire who uses their consolidated power to push for changes that the democratic process is too slow to enact.

Whether it is funding global vaccination drives, investing in experimental fusion energy, or building private spaceflight capabilities, extreme wealth can sometimes bypass bureaucratic deadlock. A critical analysis must ask: Is the problem the concentration of power, or simply who holds it? Is there a version of this playbook that actually benefits humanity, or is the structure itself the poison?

By asking these questions, we move from a simple story of “Heroes vs. Villains” to a more nuanced understanding of “Systems vs. Trade-offs.” The oligarchs may be playing a shadow game, but we are the ones buying the tickets to the show.

Let’s Discuss

We have dissected the machinery of power and challenged our own conclusions. Now, it is time to open the floor. The following five questions are designed to move the conversation from theory to reality.

1. Is “media bias” inevitable?

We often demand “unbiased” news. But is that even possible? Every story requires a human to decide what is important. Instead of asking for no bias, should we be asking for transparent bias? Would you prefer a media outlet that admits its agenda, or one that pretends to be neutral while serving a corporate master?

2. Would you accept a “dumb” regulator to avoid a “corrupt” one?

This gets to the heart of the “Revolving Door.” If we ban industry insiders from government, we get impartiality, but we might lose technical literacy. In highly complex fields like nuclear energy or crypto, which is the greater risk: a conflict of interest or a lack of understanding?

3. Are you willing to pay more to break up “Too Big to Fail” companies?

Be honest about your own habits. We love the convenience of Big Tech and the low prices of Big Retail. If breaking them up meant two-day shipping became seven-day shipping, or free services started costing money, would you still support it? How much is economic “fairness” worth to you personally?

4. Can a billionaire ever truly represent the “common man”?

We see many politicians who are ultra-wealthy claiming to fight for the working class. Is this performative, or can someone with immense privilege truly empathize with and fight for those without it? Is class interest absolute, or can ideology override it?

5. Is the internet the cure for media monopoly or a new disease?

The internet was supposed to set us free. Instead, it seems to have created echo chambers and misinformation silos. Has the decentralization of information made us smarter, or just more confused? Do we miss the days of three major TV channels, or are we better off now?

0 Comments